Is Gold Stuck in a Plateau?

Gold seems to have stopped rising; can it continue to climb?

Many attribute this to the Eastern power's cessation of gold purchases, a shallow and irresponsible understanding.

What is the real reason?

Let's start with this topic today.

Last night, there was a discrepancy between the value of U.S. PPI that I predicted and the actual value.

And when I saw the University of Michigan Consumer Confidence Index published at 10:20: the actual was 66, predicted value 68.5, previous value 68.2, I immediately realized where I went wrong.

This is the lowest value since November 2023.

Deriving and predicting PPI based on CPI trends is only effective when producers have pricing power.

But when the Consumer Confidence Index plummets, it means their consumption demand is suppressed by prices.

They don't care how "slowly" the price increase is, but the price itself is already high enough to be unaffordable.

Producers don't have pricing power, and when producers' costs increase but cannot pass on the costs to consumers by raising prices, what will they do?

Advertisement

They will lay off workers to control costs.

The U.S. unemployment rate may rise at an unexpected speed.

Similarly, recently, the trends in gold and silver prices that I predicted have always been less than expected.

Many readers ask me why the prices of precious metals seem to "not rise."

And when I got the COMEX position report on July 8th, I also immediately understood the reason.

In the position report on July 2nd, I saw a slight increase in the positions of the managed money category.

The long-term average net long position of COMEX is about 110,000 contracts.

On July 2nd, the net long position of this category was 150,185 contracts, and this increase was also normal, so I didn't pay more attention.

However, from July 2nd to July 8th, gold had risen close to its historical high, and at the same time, the open interest of COMEX suddenly surged by 104,153 contracts.

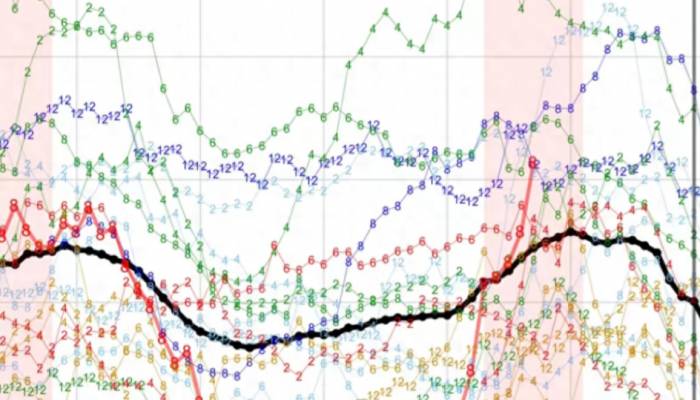

The total open interest of gold futures contracts, red is 2024, so when I saw from the position report on July 8th that the main force increasing the open interest was the "managed money" category, I understood why gold and silver would fall sharply.

Because this is a "convention", every time this category of funds buys call options, it usually comes with a sharp decline in prices, because banks holding short positions will lower the price, forcing managed money to panic and sell its positions.

Simply put, the big fat sheep of managed money entering the market is the best target for American banks to harvest.

The reason is very simple, this kind of funds are generally for hedging needs, buying gold/selling dollars, and vice versa.

So they don't need physical delivery!

Note this sentence, no need for physical delivery.

So in the eyes of big gold and silver banks, this is a group of people with a lot of money and no brains.

Usually, this kind of harvest method is effective, but I think these big banks may be too much to follow old experiences and old concepts, so as to miss an important detail, that is, the funds of the management category may also increase gold holdings for "other needs."

That is, there has been a large-scale inflow of funds into gold ETFs.

Do you still remember the chart of the obvious inflow of funds into gold ETFs that I shared before?

The main funds come from Europe and Asia.

Since 2023, global ETFs have net increased gold by 400 tons.

If you superimpose this reason, things will become extremely interesting, that is, those big banks that have been used to harvesting fat sheep and shorting gold and silver may fall into an absolute "dead loop."

The first and most core element is that these management funds that usually do not want physical delivery will also start to demand physical delivery.

There has always been a large-scale arbitrage of gold between London, New York, and Shanghai exchanges.

Recently, the EFP futures contract has increased a lot, and this EFP is a private agreement that accepts physical exchange for the other party's matching futures contract.

The increase in this kind of contract reflects that Comex contracts are replaced by London forward contracts and delivered there, and gold bars are transported to China, India and other places.

Therefore, these big banks that are used to manipulating paper gold and paper silver must face the problem of where to find physical delivery.

In addition, it is more interesting that these gold and silver banks have always used the strategy of "shorting gamma" to suppress the prices of gold and silver.

Gamma shorting sounds very obscure and difficult to understand, but in fact, it is "selling call options or buying put options."

(Selling call options is more common) However, when the demand for gold continues to increase and the price of gold continues to rise, this strategy will put gold and silver banks in a predicament.

Let me give you a simple calculation.

1.

Basic concept: 2.

Assume Morgan sold 1000 gold call options; (New Delta = Initial Delta 0.5 + Gamma 0.1 * price change of 1 dollar = 0.6) (Delta and Gamma are calculated according to pricing models, the calculation method is omitted) When the price of gold is $1800, the total exposure of Delta is 1000*0.5=500 contracts and when the price of gold is $1801, the total exposure of Delta is 1000*0.6=600 contracts.

See?

Every time the price of gold rises by $1, Morgan's selling of call options will lose $100.

This can also explain why large gold and silver banks must suppress the prices of gold and silver.

However, if we add the condition of physical delivery and look at it again, Morgan short gamma, selling a large number of call options, but the price of gold still rises, based on the requirements of physical delivery, Morgan has to buy call options to hedge the risk of physical delivery.

The more you short, the more you buy in the future, and the greater Morgan's losses will be.

This is the so-called - "absolute dead loop."

The world is changing at a speed that is hard for us to imagine, just as the platform is still full of people shouting about economic recession around M1, M2, and social financing, they are destined to be deceived by outdated data and past experiences, and ultimately make the wrong judgment.

And making the wrong judgment means you have to accept the loss.

Today's content may be a bit difficult to understand, but I believe that the interference of gold and silver will become weaker and weaker, because those big bears who have been acting on decades of experience are being settled by major changes in the times.